According to the Pew Research Center, one of the top tax-related frustrations Americans are facing is their concern over purported corporate greed.

With the proposal for increasing taxes on corporations, based on statements from top federal officials in the U.S. government including the Commander-in-Chief, many Americans are bothered that some corporations don’t pay their fair share of taxes.

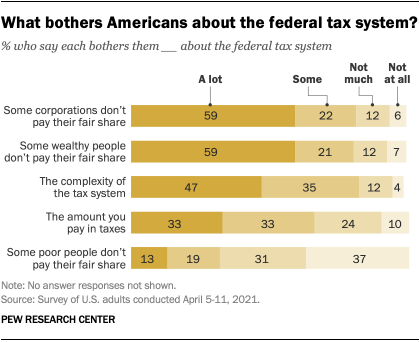

The Pew data found that nearly 60 percent of adult respondents they surveyed in early April 2021, expressed a lot of frustration over taxes some corporations purportedly avoid paying.

“The public’s frustrations with the U.S. tax system have not changed much in recent years,” the Pew data states.

“Far more Americans continue to say they are bothered “a lot” by the feeling that some corporations and wealthy people do not pay their fair share of taxes than by the complexity of the tax system or even the amount they pay in taxes.”

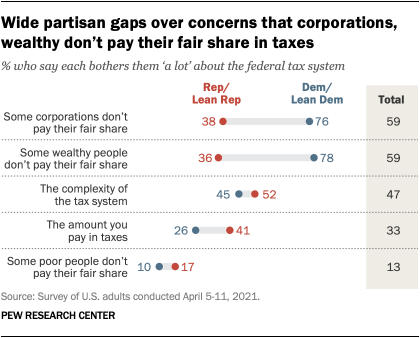

In the survey by Pew, Democrats, or left-leaning voters, were more likely to back the assertion of corporate entities not paying their fair share of taxes. 76 percent of left-leaning respondents, as opposed to 38 percent of right-leaning respondents, shared this bothersome notion.

Pew Research Center is a nonpartisan think tank devoted to public opinion polling, demographic analysis, and social science research.